Intern Breakdown #3: The Merge

The Merge explained at 3 levels of depth (👶, 🐸, 🧠)

In the beginning Vitalik created the coin and the chain.

And the chain was without staking, and ESG;

and FUD was upon the face of the deep.

And the Spirit of The Merge moved upon the face of the waters.

And The Merge said, Let there be Proof-of-Stake: and there was Proof-of-Stake.

[Ethereum 1:3]

Let’s break down the Merge for Normies (overview), Degens ($ETH), and Gigabrains (algorithms & nerd stuff).

Level 1: Normie

The Merge is a long-awaited Ethereum upgrade that will transition the blockchain from proof-of-work (PoW) to proof-of-stake (PoS). Ethereum’s development team has been working on it since 2016, and it will be the most significant update in the chain’s history.

This isn’t a deep dive on proof-of-stake (there are already a lot of good resources out there on it) but in a nutshell, PoS is a consensus mechanism — a system for deciding how blocks are added to the blockchain and which blocks are valid — with different trade-offs compared to PoW.

Consensus mechanisms are how blockchains get updated while remaining secure against fraud and attacks. Different algorithms provide different guarantees around security, efficiency, and openness, and Ethereum has decided its proposed version of PoS will achieve the best balance across these dimensions.

PoW miners incur up-front costs by investing in hardware and electricity, and then earn rewards when they use these machines to mine blocks. It’s used by Bitcoin, Dogecoin, Litecoin, Monero, and some other long-tail coins.

PoS validators, on the other hand, incur negligible up-front costs, but they must stake ETH as collateral that can be confiscated — slashed, in blockchain lingo — if they misbehave (e.g. trying to cheat the network, becoming unresponsive).

Whereas a failed PoW attack results in the loss of electricity costs, slashing a validator’s stake is the PoS equivalent of a miner burning down an entire PoW server farm in a failed attack. [Consensys]

Ethereum’s plan to swap consensus mechanisms — without pausing the network to do so (!) — is a bold, impressive feat of engineering that’s never been attempted before. But using PoS isn’t unique in and of itself. Various flavors of PoS power Solana, Cardano, Avalanche, Polkadot, Algorand, and other chains, which is why it’s funny that there are still people who claim “PoS isn’t battle-tested,” or who bring up early concerns in the crypto community that PoS might have fatal flaws.

How will The Merge affect Ethereum?

From a user experience (UX) perspective, the Merge might actually be a bit… underwhelming.

Dapps will feel the same, and ETH holders don’t need to do anything to upgrade or convert their coins. (Although there will certainly be scammers trying to “help” you migrate your coins. Don’t fall for them. See the official Ethereum docs for more details.) Core Ethereum developer Tim Beiko describes the Merge as an “under the hood” upgrade, analogous to replacing a car’s combustion engine with an electric engine while the car is being driven without the driver realizing what’s happening.

But the Merge will make Ethereum faster, right?

Eh, not really. Blocks are currently added to the chain around every 13 seconds, with a bit of variation thanks to the inherent randomness of PoW mining. After the Merge, blocks ought to arrive precisely every 12 seconds.

Thankfully, the Merge will make Ethereum cheaper.

…yeah actually it won’t help with gas prices either.

Still, the Merge is a crucial step along Ethereum’s roadmap, which includes plenty of future plans for helping the chain scale and become harder, better, faster, stronger (and cheaper). The next update on this front is the implementation of sharding, which will no doubt become a new bullish narrative whenever it’s ready to roll out, probably in mid/late 2023. [Fun fact: Ethereum’s sharding implementation is known as danksharding.]

Other benefits of the Merge include:

Changes to how new ETH is issued — more on that later

The ability to earn staking rewards by participating in pools

Enhanced security/decentralization thanks to PoS

And perhaps the biggest selling point of all:

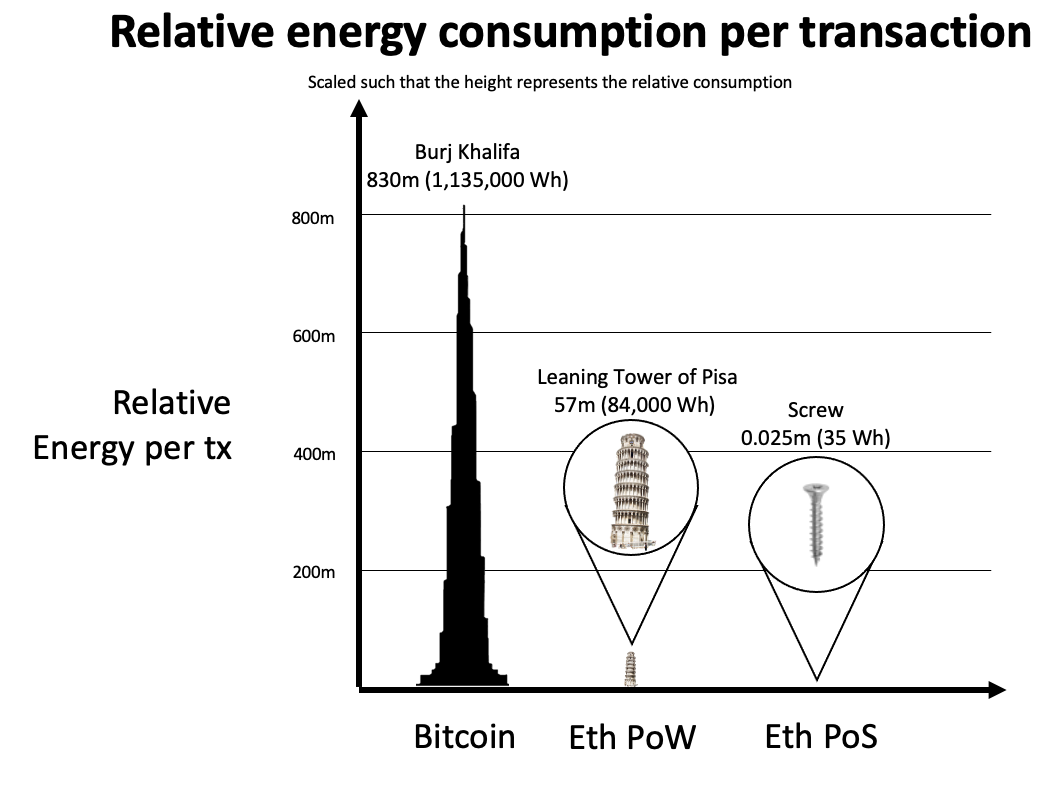

Ethereum will consume around 99.95% less energy after the Merge.

That’s right, soon you’ll be able to trade jpegs and ape into DeFi projects with a renewed peace of mind that you aren’t killing polar bears in the process. There are some seriously wild stats/analogies/images that help convey just how dramatic a decrease in energy usage this is:

[These] estimates imply that people consumed 45 times more energy watching Gangnam Style in 2019 than proof-of-stake Ethereum will use in a year. [Source]

Normie Additional Resources:

🎦 “The Best Ethereum Merge Explainer You'll Ever See” (The Defiant)

🧵 The Merge Overview (@yulesa)

🧵 "Ethereum Consensus" (@SalomonCrypto)

Level 2: Degen

Now to the topic every degen cares about most: price action. There are several factors at play here.

1. The Narrative 💬

Crypto is a narrative-driven industry, and we’ve been in a bit of a narrative drought recently. The Merge is poised to be a catalyst that could pull ETH up from its recent lows. Still, there’s an argument to be made that asset-specific drivers won’t do much good in the face of a bleak macro environment.

While the magnitude of its impact is uncertain, the Merge — assuming all goes well — is clearly bullish for both Ethereum the network and ETH the asset since it reaffirms the impressiveness of the tech, the competence of the team, and the ambition of the ecosystem. Perhaps most importantly of all, it provides a bit of hopium coming off a disastrous past few months.

2. The Tokenomics 🪙

The Merge will dramatically reduce new ETH issuance.

The Ethereum coin printer (minter?) currently goes brrrrrrrrrr, issuing around ~13,000 ETH per day in mining rewards AND ~1,600 ETH per day to those already staking on the PoS Beacon chain. After the Merge, only the 1,600 daily staking rewards will remain. This amounts to a >90% decrease in issuance (a much more subdued br with only one “r” instead of 10).

Ethereum.org has a great explainer on the pre-Merge versus post-Merge issuance systems, and ultrasound.money provides a cool dashboard for visualizing these stats. The big takeaway: miners have to be paid a lot of ETH since operating mining nodes is expensive, but staking is much less capital intensive so the rewards can be reduced under PoS. If we think of rewards as the cost of securing a blockchain, this means the Merge helps Ethereum cut its “security budget” by an order of magnitude.

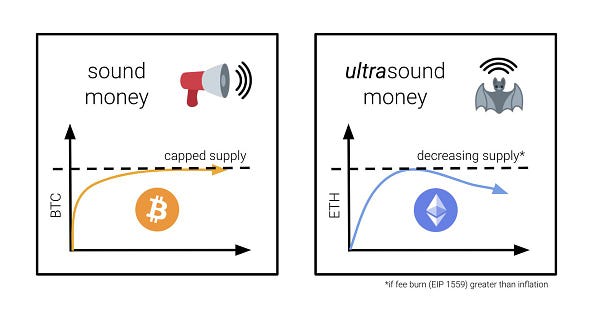

Combining this reduced issuance with the EIP-1559 update that introduced a burn mechanism last August gives us a deflationary post-Merge Ethereum. As in there will be more ETH burned than issued each day.

Needless to say, there’s a lot of hype around this aspect of the Merge, namely two memes:

“The Triple Halvening” — A comparison to Bitcoin’s “halvening” events that occur every ~4 years when block rewards are cut by 50%. ETH issuance dropping by ~90% is equivalent to three such halvenings (½ * ½ * ½ = ⅛ = 12.5%) all happening at once.

“Ultrasound Money” — If you’ve never heard this term, just listen to any Bankless podcast for 5 minutes and they’ll indoctrinate you (jk, love the Bankless guys). It’s ETH’s attempt to one-up Bitcoiners who pitch BTC as “sound money” and “digital gold.”

3. The ESG(reenbacks) 🌎 🤑

Environmental concerns have been a major factor keeping institutional investors from dabbling in crypto. Post-merge ETH will be an enticing asset since it’s (a.) one of only a few “blue chip” coins that’s been around for a while and has a solid reputation, and (b.) now palatable to investors with ESG mandates thanks to PoS’s negligible energy use.

4. The Risks 🚨

[Warning: FUD]

The Merge will [probably/hopefully/almost certainly/please dear God let it definitely] go off without a hitch. But it’s a complicated technical endeavor, and software updates have an unfortunate tendency to introduce bugs. All the comparisons to “upgrading a rocket ship while it’s flying” and “swapping a car’s engine as it’s running” sound great until you remember that this is a $100B car the devs are tinkering with. What could go wrong?

A non-exhaustive list of potential problems, roughly in increasing order of severity:

During the final Merge preparations, an issue is uncovered that requires postponing yet again. Ethereum sentiment flips from bullish exuberance to despondent cynicism.

Ethereum’s PoS has design flaws (e.g. block proposers, who can now be identified in advance, could face denial-of-service attacks) and the protocol runs suboptimally until an update can be released.

A critical bug during the Merge forces downtime while the core devs implement a fix.

The Merge acts as a catalyst for regulators to classify ETH as a security.

Any number of “unknown unknowns”

The Ethereum team is sharp, and they’ve been preparing and testing the Merge for a loooong time, so hopefully none of these come to pass. But still, when the big day arrives, knock on wood, throw some salt over your shoulder, drink some green tea and red wine — whatever you’ve gotta do to make sure we’re primed for a flawless Merge.

5. The Unlock

After the Merge, could ETH face a wave of sell pressure as stakers’ coins are unlocked? No — for a few reasons.

First of all, stakers will not be able to immediately withdraw their ETH. This will only become possible following the Shanghai update, which is expected 6-12 months after the Merge. Even after Shanghai, there will be some limits on withdrawals (although these rules are meant to ensure network stability, not to protect the price of ETH):

Only six validators may exit in a given epoch (6.4 minute period) depending on the total ETH staked at the time. This decreases to as low as four as more validators withdraw to intentionally prevent large destabilizing amounts of staked ETH from leaving at once. [Source]

Other Merge Implications

For DeFi

Staking ETH on the Beacon chain currently earns you just over 4% APR. Right now, this yield comes entirely from newly issued staking rewards, but after the Merge, stakers will also earn ETH from transaction fees and MEV. These fees will increase the effective staking return to around 8%, although other estimates have the rate as low as 4% or as high as 12%. The uncertainty around this rate comes from the several variables that factor into staking yield, including the total amount of ETH staked across the network (more ETH staked = lower base rewards for each individual validator), network activity (more activity = more ETH earned in net transaction fees), and validator uptime (a validator going offline or otherwise acting irresponsibly = some of its staked ETH gets slashed).

As Raoul Paul describes in this podcast, the post-Merge staking yield will set a “benchmark interest rate” for all of crypto. What does this mean, and why does it matter?

A benchmark helps you price risk. TradFi uses treasuries as a baseline for comparing and assessing yields offered by riskier assets like emerging markets debt and junk bonds. ETH’s staking rate ought to provide a similar benchmark for DeFi, since it’s about as safe a yield as you can get in crypto (i.e. still pretty risky since it comes with currency risk and code vulnerabilities, but safer than some random protocol’s food token farming yield).

Institutional investors will feel more comfortable jumping into crypto once this benchmark rate exists — it helps with all sorts of modeling — and it might even remind DeFi users what a sane yield looks like.

The ETH staking rate will have implications for various types of rates across crypto. For example, you probably won’t see lending protocols offering borrowers an interest rate below ETH’s yield, since arbitrageurs would borrow as much as possible, buy ETH, stake it, and earn the spread on the two rates.

For Politics/Regulation

The Merge could add a whole new layer to debates on crypto regulation. Politicians might use the Merge as an excuse to crack down on Bitcoin, saying it ought to transition to PoS to curb energy use. Then again, regulators have much bigger fish to fry on the energy front, as described here:

For Miners

If there’s one group that stands to lose from the Merge, it’s miners. Mining pools — the companies that coordinate mining activities, but don’t need to actually own any hardware themselves — have little reason to fear the Merge; it’s pretty straightforward for them to transition to a staking pool model.

Individual miners, on the other hand, will find themselves with stacks of expensive machines that no longer earn them any ETH. They could try mining other PoW coins — Ethereum Classic, for example — but it’s unlikely to be economically sustainable. The 90% of miners using GPUs (which are more general purpose chips than the uber-specialized ASICs that can only run Ethereum’s mining algorithm) could also try to pivot to a data center business model where they provide high-performance computing services.

Some mining pools are trying to help their existing customers move over to PoS, while others are more willing to embrace a new community of network participants:

“I don't think there's too much overlapping of clients,” said Da Liang, referring to the lack of crossover he’s observed between new staking pool participants and miners.

Ethereum core developer Micah Zoltu put it more bluntly: “The hope is that the demographic of validators is quite different from miners.” [Source: Decrypt]

You could argue these pools ain’t loyal, but let’s face it — miners who claim they’re getting screwed by the Merge have nobody to blame but themselves. PoS has been on the roadmap for ages, so miners should have already made preparations.

Degen Additional Resources:

Level 3: Gigabrain

Feel free to skip this section if you’re not In It For The Tech™.

What’s Actually Being Merged Again?

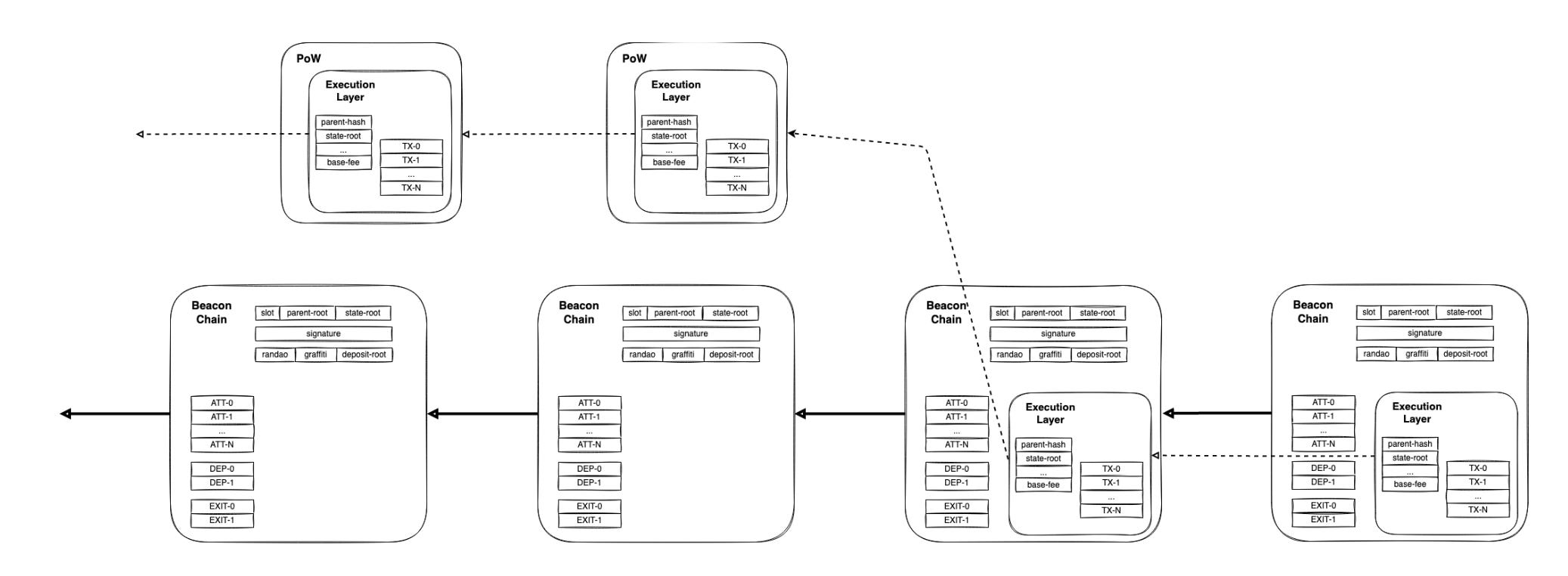

The Merge used to be branded as an upgrade from “Eth1” to “Eth 2.” In early 2022, the core developers decided to scrap this nomenclature, arguing it “creates a broken mental model for new users of Ethereum.” They proposed a new framework (which, tbh, not many people have adopted):

Eth1 ➡️ execution layer

Eth2 ➡️ consensus layer

Execution layer + consensus layer = Ethereum

As a quick refresher: the “Eth2” Beacon chain already exists and has been running in parallel with today’s “Eth1” mainnet since December 2020. The Beacon chain is processing blocks using PoS, but the blocks are essentially empty — they contain metadata related to PoS consensus but no transactions or transfers or smart contract calls. There is also currently ~13M ETH being staked on the Beacon chain waiting to be unlocked by the Shanghai update.

The updated terminology reflects the fact that Eth1 won’t cease to exist after the Merge — it will just become integrated with the consensus layer. What does each layer do again?

The Execution Layer: handles transactions, state management, the EVM. Defines execution rules for valid blocks, and is implemented using familiar clients such as Geth, Erigon, Besu, and Nethermind. These clients will continue to be used post Merge, with some slight modifications.

The Consensus Layer: uses Ethereum’s PoS algorithm to help the network reach agreement on which blocks have been added to the chain. Handles decisions around forks and the current head of the chain. Consensus clients such as Prysm, Teku, Nimbus, Lighthouse, and Lodestar are currently being used on the Beacon chain.

The Engine API is an interface that acts as the connective tissue allowing the two layers to work together. It provides a set of JSON RPC endpoints that the clients use to communicate with each other.

Merging it all together…

So the execution layer already exists as the current (Eth1) PoW chain whose nodes are running execution clients, and the consensus layer already exists as the (Eth2) Beacon chain whose validators are running consensus clients. The Merge just combines these two layers:

Take the current PoW Ethereum blocks

Call them “Execution Payloads”

Shove them into the Beacon chain blocks that are being secured by PoS

As these two layers become integrated, node operators will need to make some updates as explained in Ethereum’s readiness checklist. Beacon chain nodes must make sure they’re running an execution engine, while non-validating nodes currently on the PoW network will need to install a consensus client.

Other Technical Updates:

Some block header fields related to PoW will be removed (e.g. those related to uncle blocks, aka ommers)

PoW blockchains have probabilistic finality — there is always some chance that a block can be invalidated if a longer fork emerges. PoW Ethereum had a concept of “confirmed” blocks that were extremely unlikely to be reversed, while PoS Ethereum offers true finality and introduces the concepts of finalized and safe head blocks.

The DIFFICULTY opcode is being updated and renamed to PREVRANDAO. It will return a value pseudorandomly produced by the Beacon Chain’s RANDAO implementation which, importantly, is technically not "true randomness" as explained in depth here.

Lightning Round

There are too many details of the Merge to cover, even in a section meant for Gigabrains. The articles listed in the additional resources section below have more info on things like epochs, slots, committees, and slashing. Here’s a final lightning round of Q&A.

Will the PoW chain keep getting mined after the Merge to create a(nother) Ethereum fork?

Almost certainly, even according to Ethereum Foundation researcher Justin Drake. Most people expect the PoS chain to become the canonical Ethereum, which means the PoW fork will lose certain network effects as assets like USDC and wrapped BTC (probably) choose PoS Ethereum as their source of truth. Those tokens will become worthless on all other forks of the chain. But some (*cough* @Galois_Capital) aren’t counting PoW Ethereum out just yet, and others have devised some clever trades for immediately after the Merge. Moral of the story — things could get weird.

Is Ethereum’s PoS the same as PoS on [Solana/Cardano/Avalanche/Algorand/etc.]?

Ethereum’s implementation of PoS is based on the Gasper protocol, designed by Vitalik and others. This very complex system was named as a portmanteau of LMD GHOST (a set of rules for choosing among possible forks) and Casper FFG (a tool for marking blocks as final). It’s optimized for features such as predictable rewards and support for a very high number of validators.

How will the Merge actually happen?

Most Ethereum updates go into effect once the chain reaches a predetermined block number. But this is the Merge. Such a simple-minded approach is way too boring for this upgrade. (Also, trying to change consensus mechanisms using block height has some security vulnerabilities.)

Out of the many possible alternatives for signaling when to Merge (hanging lanterns in Boston’s Old North Church a la Paul Revere, using colored smoke like the announcement of a new pope, lighting a series of signal fires like the Warning Beacons of Gondor), the Ethereum devs decided that the Merge will be initiated when the network reaches a certain Total Terminal Difficulty threshold.

What about slashing/penalties?

Validators that go offline suffer penalties, and the penalties increase when there are many other validators offline (since this is seen as a potential attack on the chain). Staking with a validator that’s running a minority client can therefore be a smart move, since a large client that experiences a bug will force all validators using it to suffer high fees. Then, of course, there is the risk of slashing, which should only happen to validators that do something genuinely malicious. More on that in this thread:

Gigabrain Additional Resources:

Vitalik has said he considers Ethereum’s development only 55% complete — and that’s after the Merge happens. Ethereum’s roadmap still has four beautifully rhyming upgrades planned for after the Merge:

🌊 The Surge (adds sharding, will help with scalability)

🌴 The Verge (implements Verkle trees and stateless clients, makes it easier to become a validator)

➖ The Purge (removes old/unnecessary network history, helps simplify Ethereum)

🎊 The Splurge (an assortment of other “fun stuff”)

The Merge is just the start. Buckle up.